Shanghai, June 20- The two-day Lujiazui Forum opens today, gathering central bank governors, financial regulators and experts from home and abroad to discuss regulatory reforms and financial support for the economy.

China’s central bank Governor Zhou Xiaochuan and Shanghai Mayor Ying Yong will co-chair the forum, whose theme is “Financial Reform and Steady Development from a Global Perspective” this year.

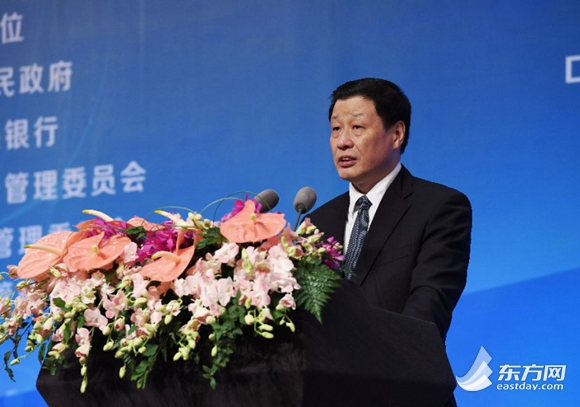

Ying said in his keynote speech that Shanghai’s building into an international financial center has made a significant progress under the central government’s unified deployment and the support of state financial management department.

He believes that Shanghai will surely become an international financial center commensurate with the country’s economic strength and the international status of the RMB by 2020.

In the coming years, Shanghai will become an international financial center which is much more open and influential, innovative and dynamic, cooperative and inclusive, said Ying.

Ying noted that the city’s building into an international financial center aims at making the domestic financial sector more dynamic and provide better service for the real economy. The financial market’s breadth and depth will be further expanded to form a multi-tiered financial market system that effectively supports the development of the real economy.

Besides, financial institutions will be encouraged to highlight their main businesses to provide strong financial support for supply-side structural reform. Ying also mentioned the importance of creating a more attractive financial environment.

And at the same time, bottom-line thinking and problem orientation should be always adhered to so as to resolutely guard against the bottom line of regional systemic financial risks and to continuously form a strong force of financial development and regulation, according to Ying.