Knight Frank launches its Global Cities 2016 Report in Mainland China to explore future trends and market performance in real estate markets of the world’s 20 leading business cities on November 19,2015. On the basis of the Global Cities 2015 Report,the number of cities increased from 15 to 20 including Beijing and Shanghai.

Office rents will be rised in key global cities

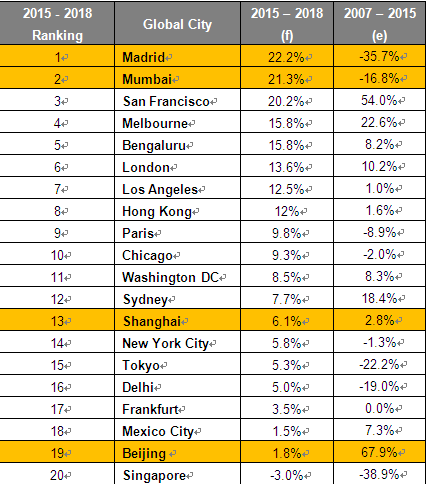

The UN is forecasting population in the world’s cities to increase by 380 million people in the next five years. The increased urbanisation, combined with greater business demand will cause office rents to rise in key global cities. Knight Frank has been tracking prime office rents in 20 of these global cities. It forecasts in 2015-2018 (year-end), eight out of the 20 global cities are expected to see double digit growth in office rents, with Madrid recording top rental growth at 22.2% by 2018, followed closely by Mumbai (21.3%). Shanghai and Beijing are expected to record 6.1% and 1.8% rental growths.

Nicholas Holt, Head of Research at Knight Frank Asia Pacific, says, “Despite the slowdown of China and its impact on the region’s economies, the Asia Pacific region will still see relatively strong economic growth over the coming years. Propelled by the huge forces of urbanisation, Global Cities in Asian countries like China and India will see much growth in the next three years.”

Peter Zhang, Director and Head of Commercial Services, Tenant Representation at Knight Frank Shanghai, indicates, as the completion date of some Shanghai office projects have been delayed, overall office rent has increased by 5.5% year on year in Q3 2015. CBD has seen fast rental growth in Q3 2015 with Little Lujiazui increasing by 11% year on year. We expect the average office rent will face downward pressure with abundant new supply in the emerging business districts.

Shanghai office market performance and the latest trend: Going underground

Office vacancy rate

With abundant new office supply in Shanghai, the overall vacancy rate increased by 2% to 5.2% quarter on quarter in Q3 2015. The emerging areas will provide significant amount of new supply. However, the office supply in these areas is very similar, driving fierce competition. It is expected that the vacancy rate will reach 10% or above. However, in core CBD, the vacancy rate will remain under 5% with limited future supply. Peter Zhang anticipates that the future vacancy rate in core CBD and emerging business districts will show a trend of polarisation.

Prime office yields

In Q3 2015, Shanghai recorded a prime office yield of 6.1%. As investors are optimistic about the medium to long-term Shanghai office market, it is expected that the strata-title office sales market will continue on an upward trend. According to the previous market experience, we believe future prime office yields will compress as rental growths are slower than the price growths.

Future office supply:

Between 2016 and 2018, there will be 4 million sq m of new office supply in Shanghai, mainly in new emerging areas. Business districts along the Huangpu River such as North Bund, Xuhui Binjiang and Post-Expo Area will witness new completions of office buildings in the coming year.

Five future trends in capital markets

We are now seeing the landscape emerge of the post-Global Financial Crisis (GFC) real estate investment market. The new environment is characterised by growing cross-border money flows, a push to diversify portfolios, and a willingness to think laterally by looking beyond the traditional sectors of offices, retail and industrial as well as search for new opportunities across the globe.

1.Specialist Property

Specialist property such as healthcare, retirement accommodation, automotive hotels and student accommodation continues to evolve as a segment. Investors have been increasingly emphasised diversification, particularly following the GFC. As yields across the traditional sectors have been squeezed, investors have sought alternative ways of protecting and enhancing their wealth. Nowadays, assets such as petrol stations, service areas, data centres and waste management facilities are now playing an increasing role in property investment portfolios.

2. Property income – long or short

Commercial real estate is an income-driven asset class whose long-term performance has been driven mainly by a high and stable level of income. However, market realities mean that more investors are being forced up the risk curve. In many western markets, a key attraction of commercial property is the availability of long leases, which provide good security of income. While in Asia Pacific, investors tend to focus more on capital values and rental growth prospects given the relatively short leases of two to five years.

3.Deregulation

Government regulation exerts a major influence on global capital flows and can help to make or break real estate investment markets. For example, the removal of ownership restrictions or legislation to allow new investment vehicles can help to attract significant amounts of inbound capital. Recently, the free trade agreement between China and Australia is expected to boost cross-border property investment between the two countries.

4.Mixed-use

Mixed-use projects offer portfolio characteristics that allow investors to spread risk, as well as gain exposure to a fast growing trend. A notable example is the Battersea Power Station in London.

5.U.S. and Chinese Outbound Capital

Traditionally, US investors have dominated cross-border investment. In the two years to June 2015, US investors invested more than $100 billion in international retail, offices, logistics and hotel property.

The recent economic slowdown in China has impacted US buyer confidence, which has led to the limited number of deals in H1 2015. Furthermore, following the stock market turbulence of summer 2015, US interest in the Chinese market may cool in the near-term. Meanwhile, due to the relaxation of regulations on overseas investments, Chinese outbound investment continues to grow, with a total of US$24 billion in overseas commercial property in the two and a half years to June.

Table 1: Office Rents % Change (forecast)

Source: Knight Frank Research, Newmark Grubb Knight Frank Research, Sumitomo Mitsui Trust Research Institute

Note: (1) All figures are year-end (2) f=forecast (3) e=estimate

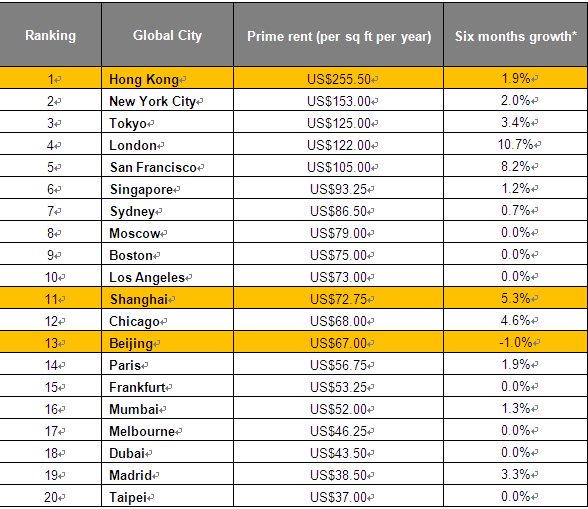

Table 2: The Skyscraper Index

Source: Knight Frank, Newmark Grubb Knight Frank, Sumitomo Mitsui Trust Research Institute

*Q4 2014 to Q2 2015