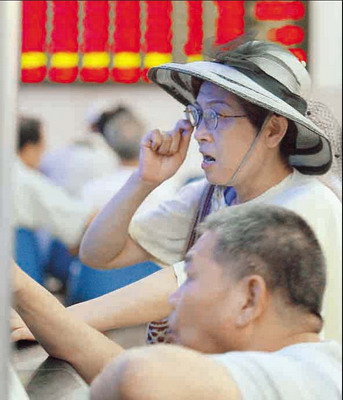

Leo Zhang/Shanghai Daily news

Investors look at a screen showing stock prices in a Shanghai

brokerage¡¯s outlet. Regulators said owners of B and H shares won¡¯t

automatically be entitled to compensation in the state share sale scheme.¡ªBen

Bao

Shanghai Forever Co, the first company with hard-currency shares involved

in China's move to revamp shareholding structure, said yesterday holders of its

Class-B shares won't be entitled to compensation.

Holders of the US

dollar-denominated shares also won't be allowed to vet the compensation package,

according to a preliminary filing to the Shanghai Stock Exchange.

The

transport vehicle maker said in its plan that owners of tradable

yuan-denominated Class-A shares will be offered 5 shares for every 10 held and

the right to vote on that proposal.

China in August extended a program to

include all its listed companies to convert US$270 billion of mostly state-owned

shares to publicly traded equities after two stages of trial sales.

Financial

regulators said earlier that owners of B shares and Hong Kong-listed H shares,

both of which are fully tradable, won't automatically be entitled to

compensation in the restructuring.

The decision on whether to include them

will rest with the holders of A shares.