Chairman of Mizuho Bank China stands witness to China’s financial opening up

At the Annual Conference of the Boao Forum for Asia (BFA) held in April, 2018, Chinese President Xi Jinping delivered a keynote speech entitled “Openness for Greater Prosperity, Innovation for a Better Future,” announcing to the world a range of major initiatives including the wider opening up of the financial industry.

As an attendee of the forum, Toyoki Oka, Chairman of Mizuho Bank China and Executive Officer of Mizuho Bank, was very excited, believing that China’s policies to allow more foreign investment in banking and securities firms and its plan to scrap limits on foreign holdings in asset management companies are very attractive and welcoming in the long run.

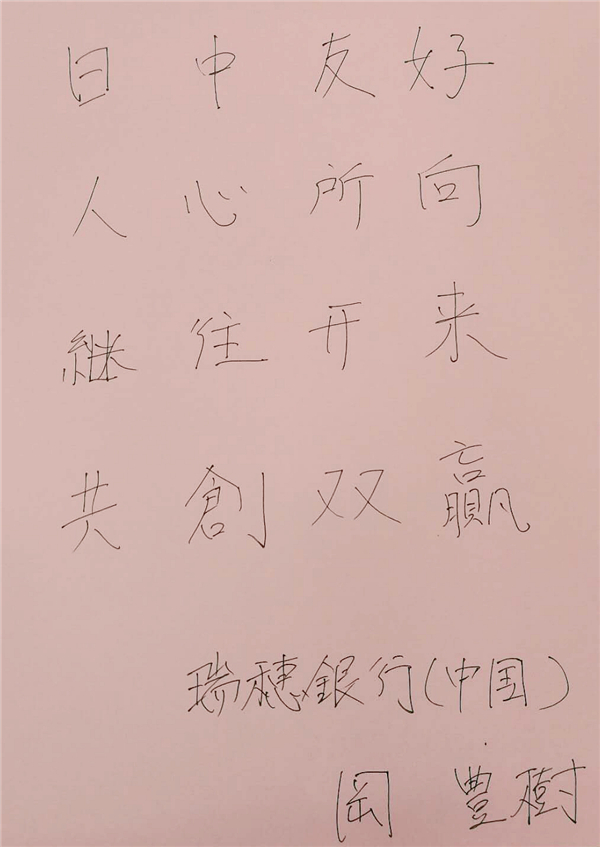

(Toyoki Oka in an interview with Eastday.com)

1st foreign bank allowed to run RMB business

Sinceit entered China in 1981, Mizuho Bank, which was known as the Industrial Bank of Japan before 2000, has witnessed and participated in the growth and opening up of Shanghai’s financial industry. The Industrial Bank of Japan, as one of the first batch of foreign banks approved in China, established offices in Beijing and Shanghai in 1981 and 1982. In 2000, Mizuho Holdings, Inc. was established originally as Mizuho Holdings, Inc. by the merger of Dai-Ichi Kangyo Bank, Fuji Bank, and the Industrial Bank of Japan.

Toyoki Oka joined the Industrial Bank of Japan in 1986. As he recalled, almost each milestone in the history of Mizuho Bank is closely related to Shanghai. What has impressed him the most was that in 1997 the Industrial Bank of Japan became one of the 1st foreign banks in China allowed to offer an RMB business.

At that time, the business scope of foreign-invested banks in China was limited to foreign currency business. Toyoki compares the RMB and foreign currency business to the two wheels of a bicycle, indicating that for foreign banks that aspire to succeed and develop rapidly in China, running an RMB business is a must. Otherwise, their development will easily become unbalanced like a unicycle.

In the 1990s, thanks to China’s emphasis on reform and opening up, more foreign banks were allowed to access China. Upon the announcement of China’s pilot program of allowing an RMB business in foreign banks, those banks were hunkering down to get the first RMB business qualification.

Toyoki, who had spent one year studying at Beijing Language and Culture University, came to Shanghai in 1994, serving the Industrial Bank of Japan (Shanghai Branch), which only had around 30 staff; while the total number of Japanese residents across Shanghai was less than 2,000.

From 1994 to 1996, the whole bank was going all out to get the RMB business qualification, according to Toyoki, who was busy with preparation together with his colleagues every day. At the same time, he had to adjust himself to life in Shanghai. As they were not good at Chinese, he and other Japanese staff had to turn to their Chinese colleagues for help when they were in trouble.

Toyoki still remembers that on the last day of 1996, Zhao Qizheng, then vice mayor of Shanghai, announced the news that the Industrial Bank of Japan was approved as the one of the first batch of foreign banks qualified to open an RMB business in China.

(Governor of the Industrial Bank of Japan Yoh Kurosawa at a meeting with Zhu Rongji, then Governor of the People’s Bank of China in 1995)

Moving to Lujiazui

For Mizuho Bank and Toyoki, March 1997 was a memorable month. Toyoki’s eldest son was born, while in the same month the Industrial Bank of Japan moved its Shanghai branch from Hongqiao to Lujiazui on March 23; with the ribbon-cutting ceremony for its RMB business being held the next day.

“Representatives of the People’s Bank of China and the Pudong New Area government, People’s Daily, Jiefang Daily, Xinhua News Agency and other media were present at the ceremony. Those scenes still linger in my mind,” said Toyoki with excitement.

Behind this joy and excitement was the context of the Chinese government’s decision to develop Pudong and build Shanghai into a global financial center. As Pudong undertook the regional function with a focus on financial services, the Lujiazui Finance and Trade Zone, as the sole development zone in China with “finance” in its name, played an important role in China’s financial opening up.

Then in 1997, the Industrial Bank of Japan, Citibank, HSBC, Standard Chartered Bank and five other foreign banks were approved by the People’s Bank of China to open RMB businesses in their Shanghai branches.

As a matter of fact, according to Toyoki, one of Mizuho Bank’s predecessors – Fuji Bank – set up a branch in Pudong as early as 1995, making it the first foreign bank to enter the Pudong New Area. The move was praised as “pioneering” by Zhao Qizheng, then director of the Pudong New Area Management Committee and vice mayor of Shanghai. Therefore, it can be said that Mizuho Bank initially settled in Pudong in 1995.

In 2007, Mizuho Bank was amongthe first batch of locally registered foreign banks and established its China headquarters in Lujiazui.

Issuance of Panda bonds

Starting in 1994, Toyoki went to China (including Hong Kong) six times, until he came to Shanghai for the third time in 2014.

During the 20 years in between, Mizuho Bank had made multiple "firsts.” It is one of the first locally registered foreign banks in China and one of the first qualified market makers against the Japanese yen in China’s foreign exchange market.

Then on December 22, 2017, Toyoki witnessed another “first”: Mizuho Bank obtained the approval of the People’s Bank of China to issue RMB-denominated bonds in China (widely known as Panda bonds).

This July, the Shanghai government introduced a total of 100 new measures in a bid to further expand the city’s financial opening up, where the local government proposed increasing the number of international investors in the inter-bank bond market and expanding the scale of Panda bonds. Once again, Mizuho Bank showed itself to be at the forefront of China’s financial opening up.

However, as Toyoki put it, it is never easy to achieve so many “firsts.” He is proud that over the past four decades, Mizuho Bank has made many contributions to Chinese society such as supporting various infrastructural constructions across China, including the Shanghai International Trade Center, Sheraton Shanghai Hongqiao Hotel, and Hotel Nikko Shanghai. That’s partly why the bank has won so much recognition in China. In addition, the bank has a global customer base, from Japan and China to Europe and America. Once its businesses become qualified in China, some programs can be rapidly promoted abroad. Lastly, Mizuho Bank boasts a high credit rating. It has received the highest ratings from S&P and Moody’s and won the trust of Japan’s finance ministry.

Mizuho Bank’s groundbreaking history in China is a perfect match with the pioneering spirit of Shanghai. Shanghai’s growth and development has mirrored that of Mizuho Bank, ensuring the latter has stayed at the forefront of the country’s financial reform and opening up.

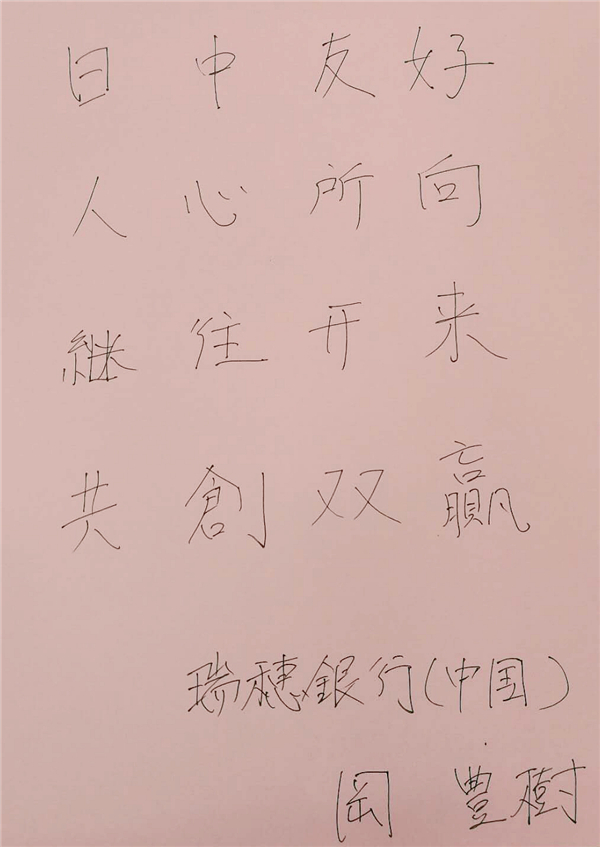

(Toyoki’s wishes for China’s further reform and opening up: The Sino-Japanese friendship has been the will of the two peoples. Building upon the past and preparing for the future, we will create win-win results between the two nations.)

Regarding China’s further opening up in the financial industry, Toyoki regards it as a major topic. “This year marks the 40th anniversary of China's reform and opening up and the 40th anniversary of the China-Japan Treaty of Peace and Friendship. Prime Minister Shinzo Abe also plans to visit China this October. Mizuho Bank hopes to make some contributions beyond the corporate framework. With regard to the Belt and Road Initiative advocated by China, we will actively help Chinese corporate clients to go abroad and support business cooperation between Japanese and Chinese companies. Personally, as vice chairman of the Japanese Chamber of Commerce and Industry in China, I will be more active in promoting Japan-China economic exchanges. I hope this year will be a significant year for both China and Japan.”

【改革开放40周年40人】瑞穗银行(中国)董事长冈丰树:见证中国金融业改革开放

时值改革开放40周年,中国金融领域频频向外推进。4月习近平总书记在博鳌亚洲论坛2018年年会上发表了题为《开放共创繁荣创新引领未来》的主旨演讲,并向世界郑重宣布了扩大包括金融业对外开放在内的若干重大举措。

“我本人也参加了今年4月的博鳌亚洲论坛。关于中国提出的‘放宽或取消外资在银行、证券领域的出资比例的限制,批准外资成立资产管理公司’等金融业的扩大开放政策,我觉得从长远来看这些政策很具魅力,非常受欢迎。”

在接受东方网“改革开放40周年40人”专题采访的时候,日本瑞穗银行股份有限公司执行官、瑞穗银行(中国)有限公司董事长冈丰树这样说。

图片说明:瑞穗银行(中国)有限公司董事长冈丰树接受东方网采访

瑞穗:第一批获得人民币业务牌照的外资银行

上海在我国金融业对外开放方面一直走在全国前列。作为在华外资银行的代表之一、日本瑞穗银行自1981年进入中国以来,见证、参与了上海金融业的成长和开放。

1981年进入中国的时候,瑞穗银行还不叫瑞穗银行,准确地说是日本兴业银行。作为第一批获准的外资银行,日本兴业银行1981年和1982年相继在北京和上海成立了办事处。2000年,瑞穗控股公司成立,下辖第一劝业银行、富士银行和日本兴业银行3家银行,瑞穗金融集团正式启动。

1986年便进入日本兴业银行如今担任日本瑞穗银行股份有限公司执行官、瑞穗银行(中国)有限公司董事长的冈丰树亲历了瑞穗“变身”前后的两个时期。从冈丰树的叙述中,我们能感受到,无论是“三大前身银行”时期,还是“瑞穗银行”时期,每一次里程碑式的发展都与上海这座城市的成长息息相关。

众多里程碑中,最让冈丰树印象深刻的1997年瑞穗银行前身之一的日本兴业银行作为首批外资银行获得人民币业务牌照的事。

当时的在华外资银行业务范围很有限,只能从事外币业务。冈丰树形象地称外币和人民币如车之两轮,也就是说想要在中国顺利展开事业、加快发展必须取得经营人民币业务的资质,否则只能如独轮车一样停滞不前。90年代随着我国改革开放的不断深入,外资银行进入我国的步伐越来越快。当外资银行经营人民币业务的试点方案一经公布,在华的外资银行都铆足了劲希望获得第一张人民币业务牌照。

距离日本兴业银行获得人民币业务牌照的3年前,也就是1994年,冈丰树才初来上海,刚刚开始在日本兴业银行的上海分行工作。和如今不同,那时常驻上海的日本人不到2000人,分行员工也只有20多个人。虽然冈丰树曾在北京语言大学留学过一年,但进入到上海这个全新的环境中不免又要费一番功夫。他说,当时买东西、看病,还有遇到麻烦事的时候中文还不是很熟练的日本员工和他们的家属们常常要依靠中国本地员工的帮忙。一方面,他忙着适应在上海的生活,另一方面,从1994年开始到1996年底的三年间,全公司都在全力以赴争取人民币业务经营资质,每天都处在繁忙的筹备工作中。

根据当时发布的《上海浦东外资金融机构经营人民币业务试点暂行管理办法》,对申请经营人民币业务的外资金融机构要求非常高:必须在中国开业3年以上,无违法或不良记录,且在提出申请前连续两年盈利;在申请前一年,外国银行分行境内外汇贷款月末平均余额在1.5亿美元以上……而且当时对外资金融机构开放人民币业务才刚刚开始起步,审核相当严格,冈丰树他们必须全力以赴。

他清楚地记得1996年的最后一天,日本兴业银行作为第一家外资银行被批准经营人民币业务,当时时任上海市副市长的赵启正正式对外公布了这一消息。

图片说明:1995年日本兴业银行行长黒澤洋与当时兼任中国人民银行行长的朱镕基副总理会谈

搬家:落户浦东陆家嘴

1997年3月,对银行和冈丰树个人来说,都是一个值得纪念的重要的时间节点。冈丰树的长子在那个月出生了。而同月23日本兴业银行上海分行从虹桥的国际贸易中心迁至了浦东的陆家嘴;24日,日本兴业银行人民币业务开业剪彩仪式正式举行。

“剪彩仪式那天,浦东新区、人民银行的代表,还有人民日报、解放日报、新华社等媒体都来了。那时的场景我至今记忆犹新。”说起这件事冈丰树仿佛依旧充满了当年的喜悦和激动。

而在这场喜悦和激动的背后,是1990年中共中央和国务院决策开发浦东、1992年确立建设上海国际金融中心的战略目标的大背景。当时,上海建设中国特色社会主义现代化大都市的功能定位为经济、金融、贸易和航运四个中心,浦东则承担起了以金融服务为主的区域功能。浦东“陆家嘴金融贸易区”是全国唯一一个以“金融”命名的开发区,也成为了中国金融对外开放的重要舞台。

在此之后,才有了1997年,中国人民银行先后批准落户浦东的日本兴业银行、花旗银行、汇丰银行、渣打银行等9家外资银行的上海分行,依据《上海浦东外资金融机构经营人民币业务试点暂行管理办法》,率先进行经营人民币业务的试点的事。

冈丰树说,其实早在1995年,瑞穗银行前身之一的富士银行在浦东几乎看不到一幢像样的办公大楼的情况下,就很看好浦东的发展前景,毅然决定在浦东开设分行,是首家入驻浦东新区的外资银行。时任浦东新区管委会主任、上海市副市长的赵启正先生称赞此举为“一马当先”。如此算来,说瑞穗银行早在1995年就已经落户浦东了。

2007年,瑞穗成为了第一批获准在华注册法人银行的外资银行,继续将瑞穗中国的总部设在浦东陆家嘴。

熊猫债:又又又一个“第一”

从1994年开始,冈丰树先后六次赴香港和中国大陆工作,2014年冈丰树第三次来到上海并工作至今。1994年到2014年这20年间,瑞穗银行取得了“首批在华注册法人银行的外资银行之一”“首批取得中国银行间外汇市场人民币对日元直接交易做市商资格的银行之一”等多个“第一”。

而这一次,冈丰树也有幸亲眼见证了另一个“第一”:2017年12月22日,瑞穗银行宣布,获得了中国人民银行批准将在中国境内发行以人民币计值的债券,即“熊猫债”。距离1997年获得经营人民币业务资格也是整整20年。

今年7月10日,为贯彻落实国家进一步扩大开放重大举措,加快建立开放型经济新体制,上海制定了“上海扩大开放100条”行动方案。其中第四部分“推进更高层次的金融市场开放”提到要“进一步丰富银行间外汇市场的境外参与主体,增加银行间债券市场国际投资者数量,扩大熊猫债规模。”可见瑞穗银行再一次走在了中国金融业开放的前端。

我们不禁疑惑,为何瑞穗银行在中国可以取得那么多个“第一”?

冈丰树说道:“取得第一并不是件简单的事。我觉得有这样几个原因,首先我觉得我们可以自信地说,在过去改革开放的40年中瑞穗银行始终扎根中国、为中国社会作出了许多贡献,比如在中国各地支持各类基础设施的建设,其中包括上海国际贸易中心、虹桥喜来登上海太平洋大饭店、上海日航饭店等众多项目,这是我们被‘认可’的原因之一。其次,我们有遍布世界的客户基础,不仅仅有日本的,还有中国的、欧美的的客户。如果给予我们‘第一’的资格的话,一些方案可以很快推广出去。最后瑞穗银行的信用评级很高,过去曾获得了标准普尔和穆迪的最高评级,还获得了当时的大藏省(编者注:当时日本中央政府机构,2000年后被重编为今天的财务省和金融厅)等政府相关部门的信任。”他的言语中不乏自豪之情。

从首批在中国开展银行业务的外资银行,到首批获得人民币业务牌照的外资银行,再到如今的“熊猫债”,不管哪个项目,瑞穗银行“力争第一”,这和凡事“力争先行先试”的上海性格不谋而合。这也使得瑞穗银行在这近40年来和上海这座城市一起,始终处在中国金融业改革开放的前沿。

图片说明:冈丰树对改革开放再出发的寄语:日中友好、人心所向、既往开来、共创双赢

今年4月中国国家主席习近平在博鳌亚洲论坛向世界郑重宣布了扩大包括金融业对外开放在内的若干重大举措,对此冈丰树表示:“金融改革开放是一个很大的课题。今年是中国改革开放40周年,是中日和平友好条约缔结40周年的关键之年,安倍总理也计划于10月访华。我们瑞穗希望可以做出超越企业框架的一些贡献。对中国倡导的‘一带一路’战略,瑞穗将积极帮助中国企业客户走出去、支持中日企业间的业务合作。同时,自己作为在中国的日本商会副会长,也会更加积极推进中日经济交流,希望今年对中日双方而言都是有意义的一年。”