Group photo (Photo by Cao Jun)

10 March, Shanghai – Knight Frank, the independent global property consultancy, and BOCI jointly launch The Wealth Report 2016 in Shanghai. As the strategic media partner with Knight Frank for the first time, Eastday will provide a multilingual issuing of The Wealth Report on a variety of platforms via the new media. Now in its 10th year, the report tracks the growing super-rich population in 98 cities across the globe, and analyses global wealth trends, prime global residential market and commercial property performance.

According to the report, 2015 marks the first annual dip in ultra-wealthy population since the global financial crisis began in 2008. Since The Wealth Report was first published 10 years ago, the global population for UHNWIs has grown by 60%, with emerging economies recording the fastest growth.

Piers Brunner (Photo by Fan Yicheng)

"It is widely regarded as the authoritative guide to real estate related wealth matters and as such was referenced in over 9,000 media articles in the last year", said Piers Brunner, CEO for Great China of Knight Frank.

Xu Shiping

Xu Shiping, President and Editor-in-Chief, Shanghai Orient Webcasting Co.Ltd. said in the speech that as one of the key news websites in China and a mainstream media in Shanghai, Eastday will play the advantage of the Internet new media, try its best to provide professional and reliable information services to users and raise the popularity of the Wealth Report at home and abroad, reflecting the real value of the report.

Nicholas Holt, Head of Research for Asia Pacific, says, “Of the 19 countries tracked within Asia Pacific, 12 saw their UHNWI population fall in 2015, principally as a result of global macro-economic events, including the Chinese slowdown, the fall in the price of oil, volatile equity markets and the strengthening of the US dollar. Looking at a longer time horizon however, Asia especially has been a fertile ground for the growth in the number of UHNWIs, with more individuals surpassing the US$30m barrier than in any other region over the last 10 years.

Shanghai is home to one of the top 10 luxury residential markets

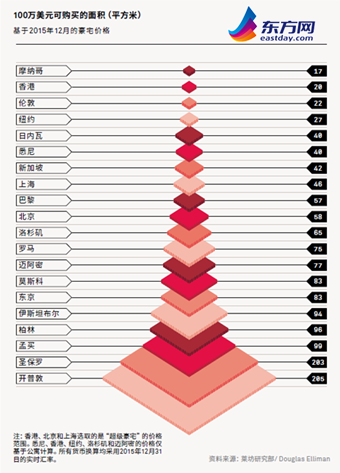

According to the latest Knight Frank Prime International Residential Index (PIRI), prime prices in Shanghai recorded a growth of 14% year-on-year in 2015, following Vancouver (24.5%) and Sydney (14.8%). And Monaco - for the ninth consecutive year – is confirmed as the most expensive city to buy luxury residential property, with US$1m buying just 17 square metres of accommodation. Shanghai is ranked at the eighth place with US$1m buying 46 square metres.

Regina Yang, Director and Head of Research and Consultancy at Shanghai, says, “A series of favourable policies including the reduction of mortgage rates and taxation, in addition to the new supply of luxury homes and the high land prices are all the major reasons behind the soaring property market. If the property prices continue to increase, we believe that there will most likely be tightening measures in the second half of this year.”

Global Wealth Movement

The general trend over the past decade has been for significant growth in cross-border investment, led by massive growth in outflows from China (+1,471%) from 2005 to 2015. Looking at inward investment, China has seen notable growth (+500%) as well in the same period of time.

David Ji, Director and Head of Research and Consultancy for Greater China, notices that increasingly UHNWIs from China are expanding from residential into investing in commercial properties, especially in the US, either individually or through a private equity fund. Although this trend is not unique to Chinese wealthy, this does imply that the regional hubs in countries like the US will see more small to mid-cap commercial investment going forward.

Seasonal Wealth flows

This year Knight Frank teams up with NetJets and WINGX to bring an interesting concept - how global sporting, art and business events create private-jet hotspots, which is based on the fact that seasonal and temporary movements are also instrumental in boosting demand for second-home purchases. The list of private-jet clusters is dominated by European and US events, mainly due to the maturity of private aviation in these markets. But as Asia and other markets mature, private jet operators are gradually increasing their operations.

The report also shows that there has been some rebound in high-end tourism to the Greek islands and increasing VIP travel to resorts in Turkey. In the future, Istanbul should be an increasingly popular host-location for VIP events, such as boat shows and Grand prix. Elsewhere, Brazil should have exciting long-term growth in terms of private jet demand with a boost from the Rio Olympics later this year.

Commercial Property

Knight Frank’s capital markets experts look at the key trends of the past decade, future opportunities for private investors and landmark deals in their market.

“The expansion of interest in commercial property from a swelling population of wealthy individuals has perhaps been the most notable trend in the past decade. We expect assets in the key Western markets will continue to be targeted by Asian private investment, while a slow maturing of domestic markets and the growth of different methods of investing – from REITs in India and China, to syndicate or club-type deals that increase UHNWI exposure to the commercial real-estate market.”

David Ji, Director and Head of Research and Consultancy for Greater China says, “Chinese institutional investors have dominated the market in the past, but we are starting to see a new wave of Chinese investors venture offshore. These new investors dominate small to mid-cap private investments in primary and secondary locations. The US remains the stand-out location for UHNWIs, but Hong Kong, being closer to home, is also considered an attractive location for them to invest in commercial property in decentralised locations.”