This July, the Shanghai government introduced a total of 100 new measures in a bid to further expand the city’s financial opening up, where the local government proposed increasing the number of international investors in the inter-bank bond market and expanding the scale of Panda bonds. Once again, Mizuho Bank showed itself to be at the forefront of China’s financial opening up.

However, as Toyoki put it, it is never easy to achieve so many “firsts.” He is proud that over the past four decades, Mizuho Bank has made many contributions to Chinese society such as supporting various infrastructural constructions across China, including the Shanghai International Trade Center, Sheraton Shanghai Hongqiao Hotel, and Hotel Nikko Shanghai. That’s partly why the bank has won so much recognition in China. In addition, the bank has a global customer base, from Japan and China to Europe and America. Once its businesses become qualified in China, some programs can be rapidly promoted abroad. Lastly, Mizuho Bank boasts a high credit rating. It has received the highest ratings from S&P and Moody’s and won the trust of Japan’s finance ministry.

Mizuho Bank’s groundbreaking history in China is a perfect match with the pioneering spirit of Shanghai. Shanghai’s growth and development has mirrored that of Mizuho Bank, ensuring the latter has stayed at the forefront of the country’s financial reform and opening up.

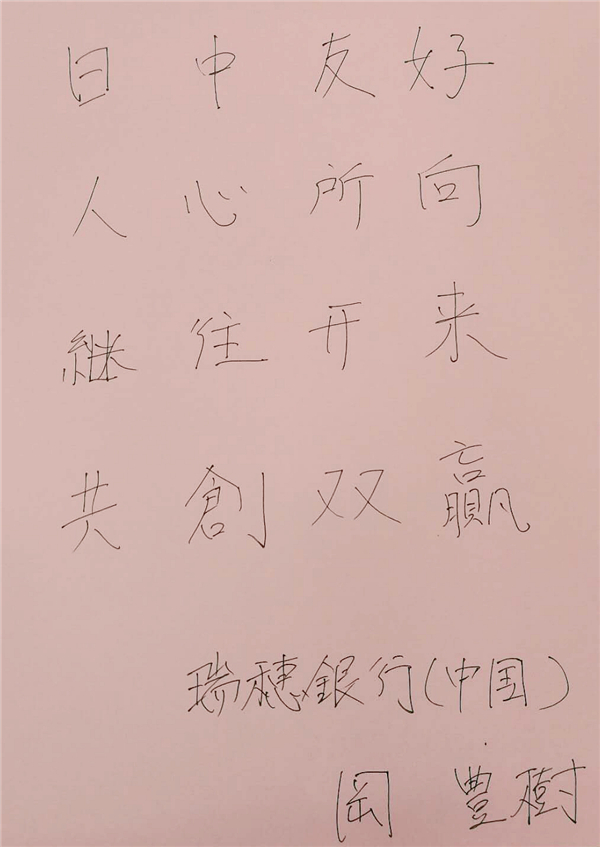

(Toyoki’s wishes for China’s further reform and opening up: The Sino-Japanese friendship has been the will of the two peoples. Building upon the past and preparing for the future, we will create win-win results between the two nations.)